The Financing Process

Demystifying Home Loans

The home loan process can feel overwhelming. By collaborating with a trusted lender and remaining informed through every step of the process, from pre-approval to closing, you can have a significantly more comfortable experience. You’ll want to consult with a mortgage specialist (or two) to find a professional who you are confident will provide you with the best care.

To get an idea of what to expect, review the following home loan process steps.

Step One:

Get Pre-Approval

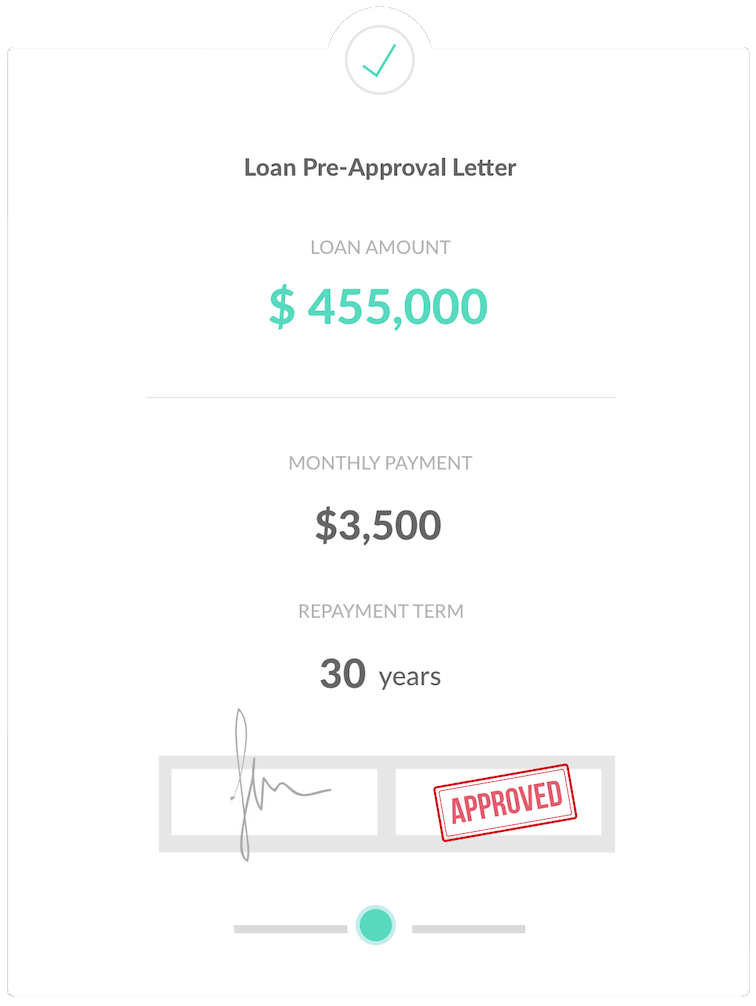

Before you start looking for a home to buy, it’s wise and proactive to meet with a lender to get pre-approved for a loan amount. Offers accompanied by a pre-approval letter are stronger and will stand out, especially when the seller is receiving multiple offers.

To gain pre-approval, your preferred lender will gather information about income, assets, and debts to help determine how much you can borrow. This includes gathering a credit report, W-2 forms, pay stubs, federal tax returns, and recent bank statements.

There are a variety of home loan programs offering different advantages depending on your unique needs and preferences. Your preferred lender can go over the specifics of each to ensure you find a loan option that best aligns with your needs.

finance with

Paul Johnson

Envoy Mortgage

- NMLS ID # 575028

- (314)359-9106

- 100 Chesterfield Business PKWY,2FLR St. Louis, MO 63005

As a dedicated mortgage professional, my purpose is to fulfill your dreams of homeownership. Our company doesn't simply offer some of the most competitive rates in the mortgage industry; we provide impeccable service from start to close. I'm committed to delivering each borrower a hassle-free mortgage experience by providing breakthrough technology, transparent communication, unparalleled turn-times and, most importantly, around the clock attention to your loan. The home buying process can seem challenging, but having the right people and resources by your side can make all the difference. Contact me today to learn more!

Let's Get StartedEstimate Your Monthly Payment

Estimate your mortgage payment, including the principal and interest, taxes, insurance, HOA, and Private Mortgage Insurance.

Price

Annual Tax

Loan Term (Years)

Down Payment %

Interest Rate %

Monthly HOA

Monthly Insurance

$3,198.20

Estimated Monthly Payment

Principal

$2,398.20

(75.0%)Taxes

$500.00

(15.6%)Private Mortgage Insurance (PMI)

$0.00

(0.0%)HOA

$100.00

(3.1%)Insurance

$200.00

(6.3%)

finance with

Julie Green

Loan Originator

- NMLS: 236490

- (314) 221-3068

- 1717 Hidden Creek Court, Office#29A Saint Louis, MO 63131

As a dedicated mortgage professional, my purpose is to fulfill your dreams of homeownership. Our company doesn't simply offer some of the most competitive rates in the mortgage industry; we provide impeccable service from start to close. I'm committed to delivering each borrower a hassle-free mortgage experience by providing breakthrough technology, transparent communication, unparalleled turn-times and, most importantly, around the clock attention to your loan. The home buying process can seem challenging, but having the right people and resources by your side can make all the difference. Contact me today to learn more!

Let's Get Started

Step Two:

Find the best loan

Collaborating with a top-notch local loan officer will ensure you have access to competitive rates and programs that best fit your individual needs. Take the first step by completing this form to get connected today!

Step Four:

Signing and finalizing the deal

Once your loan is approved, you’ll need to set up homeowners insurance.

Your documents will be sent to the title company and the closing will be scheduled for you to sign the necessary paperwork and pay any additional costs to complete the purchase of your new home.

After the loan goes through the required recording process, the purchase is complete, and you officially own your new home!